Everyone wants to ensure that their hard-earned assets transition smoothly to their loved ones when their lifetime ends. However, when starting to plan for this inheritance work with the help of a professional, the most probable question is, whom should you consult – a probate lawyer or an estate attorney near you? Though their work intersects with matters of inheritance, their roles diverge significantly. Understanding this distinction is paramount when dealing with the complexities of estate planning and ensuring a smooth transition for your beneficiaries.

Let’s untangle these knots of confusion and give you a clear description of both while also highlighting the difference between them.

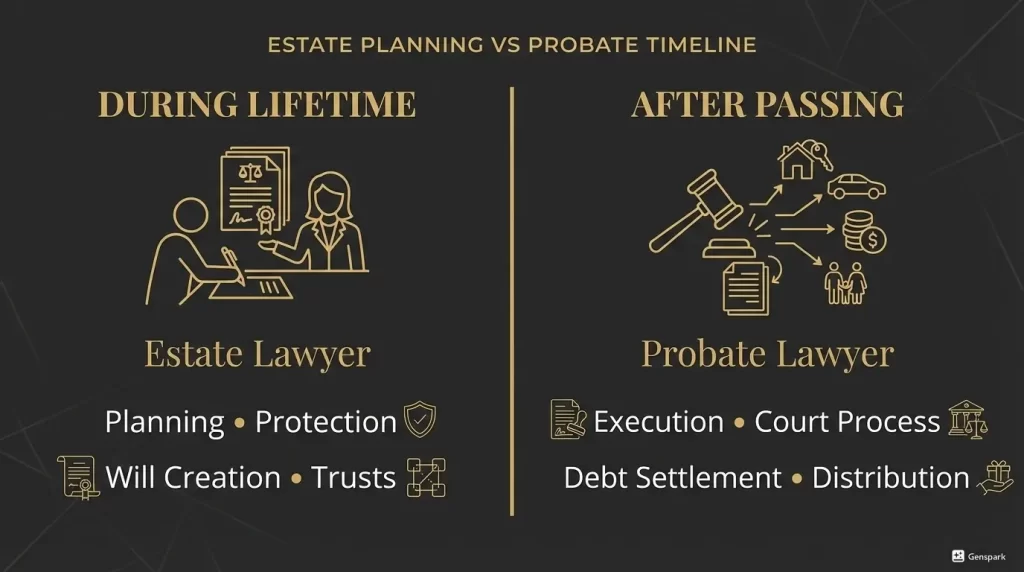

Overview of Estate and Probate Legal GuidancePlanning for the future or handling the affairs of a loved one can be overwhelming, but you do not have to do it alone. The distinction lies in the timing and the objective. If you are looking to protect your assets and define your legacy while you are alive, an estate lawyer is your partner in planning. If you are navigating the legal complexities following the death of a loved one, a probate lawyer is your guide through the administration process. Consulting the right professional ensures that your hard-earned assets are managed according to your wishes and that the transition to your beneficiaries is as seamless as possible. Whether you are drafting a blueprint for the future or managing the settlement of an estate, expert legal counsel provides the peace of mind that your family’s financial future is secure. |

Understanding an Estate Lawyer

An estate lawyer is a professional who assists individuals and families with matters related to estate planning. In simple words, estate lawyers guide clients in effectively planning the administration or distribution of their assets, belongings, property, debt, and other associates after their passing. Their services include:

Will Creation: A well-drafted “Will” specifies how you want your assets distributed after your passing. An estate attorney ensures it complies with state laws and uses correct & clear wording to minimize potential disputes.

Trust Establishment: Trusts can be powerful tools for asset management and tax minimization. You will receive advice from an estate lawyer on different trust types (living trusts, revocable trusts, etc.) and tailor one to your specific needs.

Powers of Attorney: These documents are dedicated to providing legal authority to someone you trust to handle your financial or healthcare decisions if you become incapacitated. In this process, the estate lawyer can ensure that documents are written comprehensively and are legally valid.

Tax Planning: Estate planning is not bound to just asset distribution. Skilled attorneys can explore strategies to minimize estate taxes and ensure your beneficiaries receive the maximum amount possible.

Beneficiary Designation: Certain assets like retirement accounts or life insurance have designated beneficiaries. An attorney can review these designations and ensure they align with your wishes.

Incapacity Planning: There might be times when you become incapable of making decisions; thus, it is essential to plan for such scenarios in advance. You can create documents like healthcare directives outlining your wishes for medical care precisely with the assistance of an estate lawyer. Additionally, understanding your estate plan can help your family later determine when to hire a probate lawyer and what their role entails, ensuring your assets are managed smoothly after your passing.

Understanding a Probate Lawyer

Probate lawyers play a role in handling the inheritance process for assets after a person’s death. They guide the executor (person named in the will to handle the estate) through the probate court process, ensuring the assets are settled efficiently and legally. A probate lawyer’s services include:

Probate Administration: Probate involves filing the will with the court, notifying creditors, appraising assets, paying debts and taxes, and finally, distributing the remaining assets to beneficiaries. This legal process can be difficult to navigate; therefore, support from a probate attorney is vital.

Debt Settlement: The estate is responsible for settling the deceased’s debts before beneficiaries receive anything. A probate lawyer ensures creditors are paid fairly and efficiently.

Asset Inventory and Valuation: The lawyer helps locate and value all estate assets, including property, investments, and personal belongings.

Beneficiary Communication: The attorney facilitates communication with beneficiaries, keeping them informed about the probate process and their inheritances.

Dispute Resolution: Unfortunately, disagreements among beneficiaries can arise, and a probate attorney can mediate disputes or represent a client in court to protect their inheritance rights.

Intestacy Laws: If someone dies without a will (intestate), state laws have the authority to declare how the assets are distributed. A probate lawyer can ensure this process adheres to legal requirements.

Estate or probate? The difference matters. Plan ahead with us to protect what matters most.

Key Differences Between Probate and Estate Lawyers

Timing

The major difference between the two is that estate planning lawyers are focused on planning the will during the individual’s lifetime. Whereas probate lawyers are involved in the after-death asset inheritance and settlement process.

Primary Tasks

Estate Lawyer:

Offering you a direction to plan your asset inheritance effectively. Lawyers may help with incapacity planning for situations where you can’t make decisions.

Probate Lawyer:

Guide through the probate court system to ensure the will is valid and debts are settled. Oversees the distribution of assets to beneficiaries as outlined in the will or according to intestacy laws (if no will exists).

May resolve disputes among beneficiaries.

Client Difference

Estate Lawyer: Works with you when you want to plan the after-death distribution of your assets. Families or other beneficiaries may also be involved in this process.

Probate Lawyer: Typically works with the executor of the will (appointed person to manage the estate) or beneficiaries after you’ve passed away.

Contact MBB to Consult with an Estate Lawyer or Probate Lawyer in Texas

Dealing with estate planning or the probate process can be complex and needs sound knowledge of legal terminologies and regulations involved. Let MBB’s experienced lawyers help you with this planning and ensure that your assets transfer process is smooth.

Having vast industrial experience and legal understanding, we can assist you in both probate and estate planning.

Wrapping Up

By understanding the distinct roles of estate and probate lawyers, you can ensure to consult the right professional according to your needs. Consulting with an estate lawyer near you before your passing allows you to make informed decisions and establish a clear roadmap for your wishes. After your passing, a probate lawyer near you can guide the executors through the legalities of settling the estate.

Frequently Asked Questions

Can the same lawyer handle both estate planning and probate?

Yes, many law firms and individual attorneys specialize in “Trusts and Estates,” meaning they handle both sides of the coin. However, the specific function they perform depends on whether the client is planning for the future or managing an estate after a death.

If I have an estate lawyer and a Will, do I still need probate?

Having a Will does not avoid probate. In fact, a Will instructs the probate court on how to distribute your assets. To avoid probate, your estate lawyer might suggest creating a Trust. If you only have a Will, your family will likely need a probate lawyer to guide them through the court process.

Is a probate lawyer expensive?

Probate costs vary by state and complexity. Some lawyers charge a flat fee, others charge an hourly rate, and in some states, they are entitled to a percentage of the estate’s value. These fees are generally paid out of the estate assets, not by the family members personally.

When should I hire an estate lawyer?

You should hire an estate lawyer whenever you have assets you want to protect or if you have specific wishes for your healthcare and children. Major life events, such as marriage, the birth of a child, divorce, or buying a home, are excellent triggers to update or create an estate plan.